Twitter caused the Stock Market to Crash! (not really)

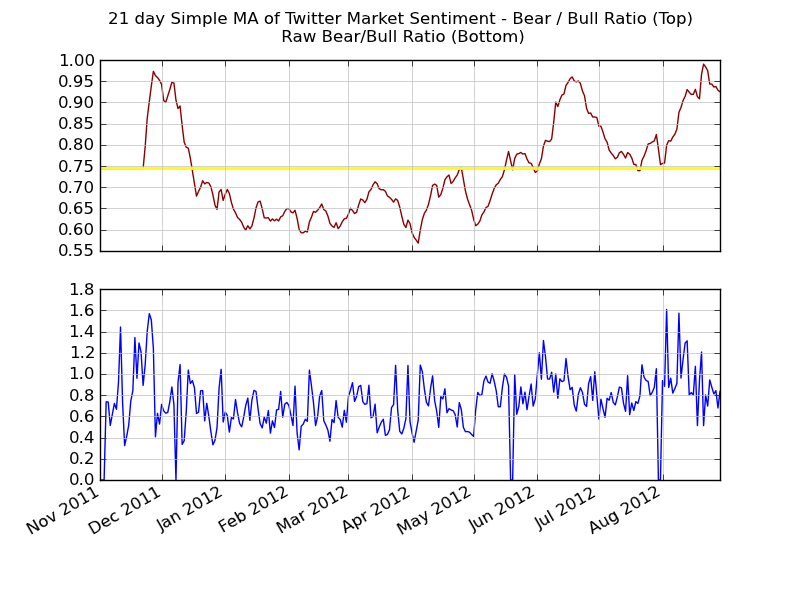

This is a cross-post from Trade The Sentiment.

On April 23 2013, the Associated Press reportedly had their Twitter account hacked.

At 1:07PM Eastern Time, a Tweet was sent out that claimed an explosion at the White House. Here’s the Tweet:

About 2 minutes after this Tweet was