The Insurance Industry and Big Data

How would you feel if you got a letter in the mail from your insurance company telling you that your insurance rates have increased due to your social media activity? Maybe they noticed an increase in your conversations about speeding or smoking or something even much more dangerous.

How would you feel if you got a letter in the mail from your insurance company telling you that your insurance rates have increased due to your social media activity? Maybe they noticed an increase in your conversations about speeding or smoking or something even much more dangerous.

How would you feel about getting a letter from your insurance company telling you your rates have decreased due to your social media activity falling into line with other ‘safety’ conscious customers? You’d probably be happy about that. Additionally, what if you received a letter from your insurance company saying your rates dropped because they’ve been able to cut down on fraud by 50% due to social media?

Most of us wouldn’t be terribly happy about getting that first letter but we’d be pleased to see the other two types of letters. In the first example. most of us would be a bit upset at the lack of privacy but the other two examples we’d be happy that companies were using social media to cut costs.

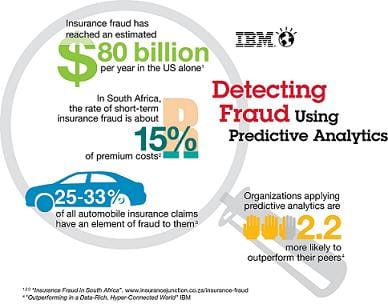

Big data has given insurance companies the ability to mine social media for all sorts of activities. According to reports, insurance companies are beginning to investigate the use of social media and data analytics to make more informed pricing decisions. This could effectively lead to price increases or decreases for many. Big data can give insurance companies the ability to build specific pricing for you based on your activities and behaviors. How better to find out your behaviors than to mine your social media activities?

We’ll be happy with the decreases and we’ll most likely not care about the reason why. But have a few rate increases thrown at us due to social media, we’ll be angry and we’ll be screaming about ‘privacy’.

What are your thoughts? Should insurance companies be able to mine your public social media presence to determine rates on your insurance?

Comments ()